Raises came at the beginning of October, and now that we’re in the Open Enrollment period, it’s a good time to be thinking about your own financial and retirement planning. Below you can find directions on how to check your raise and ways to make your money go further.

Former SHARE union co-president and CT Tech Jay Hagan provided brilliant patient care at UMass Memorial for several decades. And now he’s now making the most of the SHARE retirement benefits!

UMass Memorial Legal Services

In addition to investing in your future self by upping your contribution to your 401k, you might consider using the UMass Memorial Legal Assistance Plan to prepare for the future.

Former SHARE Union President Jay Hagan used those services before his own retirement, and had good things to say about it. “Before, I called a financial advisor, and was told that the services I wanted would cost me three or four thousand dollars. So, instead, I got set up with the Legal Assistance Plan for one year, and saved a lot.

“I called MetLaw and they provided me a list of local lawyers to choose from. I met with one a couple of times . . . he was friendly and competent. There are additional expenses that you have to pay to Massachusetts for things like recording fees, but all of the legal bills get directly to MetLaw. If someone dies, it’s bad enough to grieve, and I don’t want my wife or me to have worry about all this then. I’m so glad I’ve got my will and everything taken care of.”

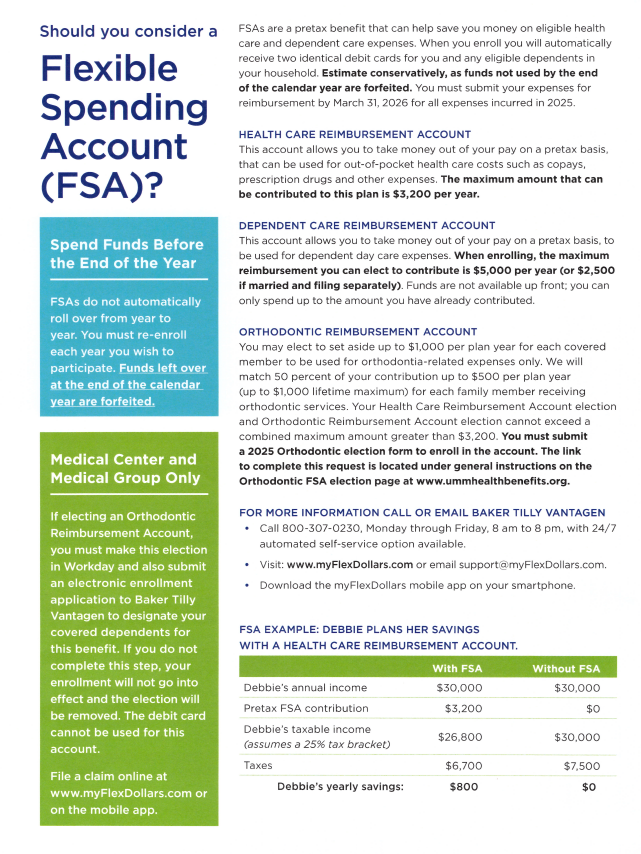

Could a Health Care Flexible Spending Account Work for You?

UnionPlus Benefits for SHARE Members

If you’re signed up for SHARE, you’re also eligible for the perks, discounts, and low-cost programs for union members through the nationwide UnionPlus program, which also includes financial services such as personal loans, student debt help, credit card debt settlement, and more.

How to Check Your Raise

The recent raise became effective 9/29/24, and was reflected in the first paycheck after that date.

Your raise was 4.5% of your old hourly rate, or $1.00 per hour, whichever amount was larger.

For more information about the structure of the raise, and how to calculate your own, and what happens if your pay has reached the Max Cap, check out this page about raises.

Many more of the most common questions are answered in this FAQ from the last contract agreement. This raise is the third of four annual raises negotiated for this contract period.

You can confirm that your raise was processed in Workday. Just log in and go to your profile, then select “Compensation” (see example image below from the Workday app.)

If you have questions or concerns about your raise, please contact the SHARE Organizer for your area. You can also call SHARE at 508-929-4020 or email share.comment@theshareunion.org.

You will see your Pay Raise reflected in the “Compensation” section of Workday, as well as in your “Pay Change History”