SHARE Retirement Benefits

at UMass Memorial Medical Center

Our Pension Plan | what is it?

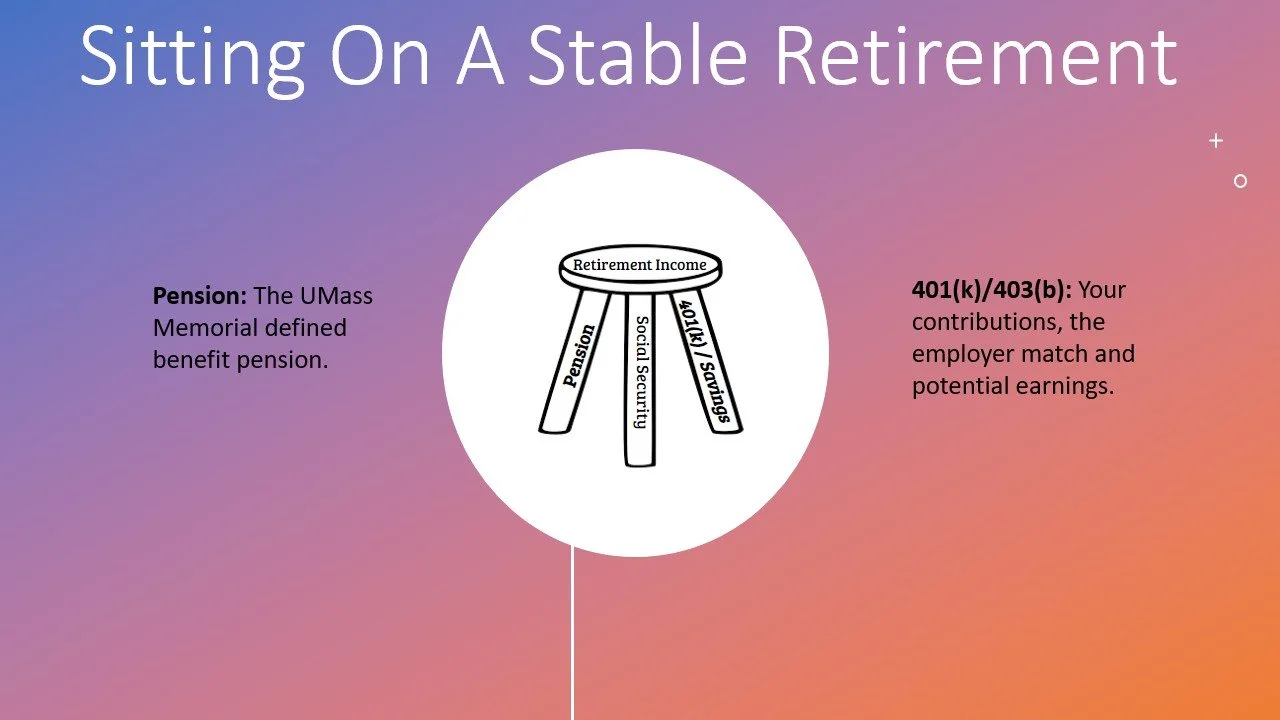

When you retire, UMass Memorial Medical Center will pay you a defined benefit pension. The pension is a lifetime annuity –- meaning you get a check every month for the rest of your life – though there is a lump sum payment option available, too. SHARE negotiated the pension in our contract. You are automatically enrolled in the pension program and you don’t need to do anything until it’s time to retire.

Pension Formula | what counts?

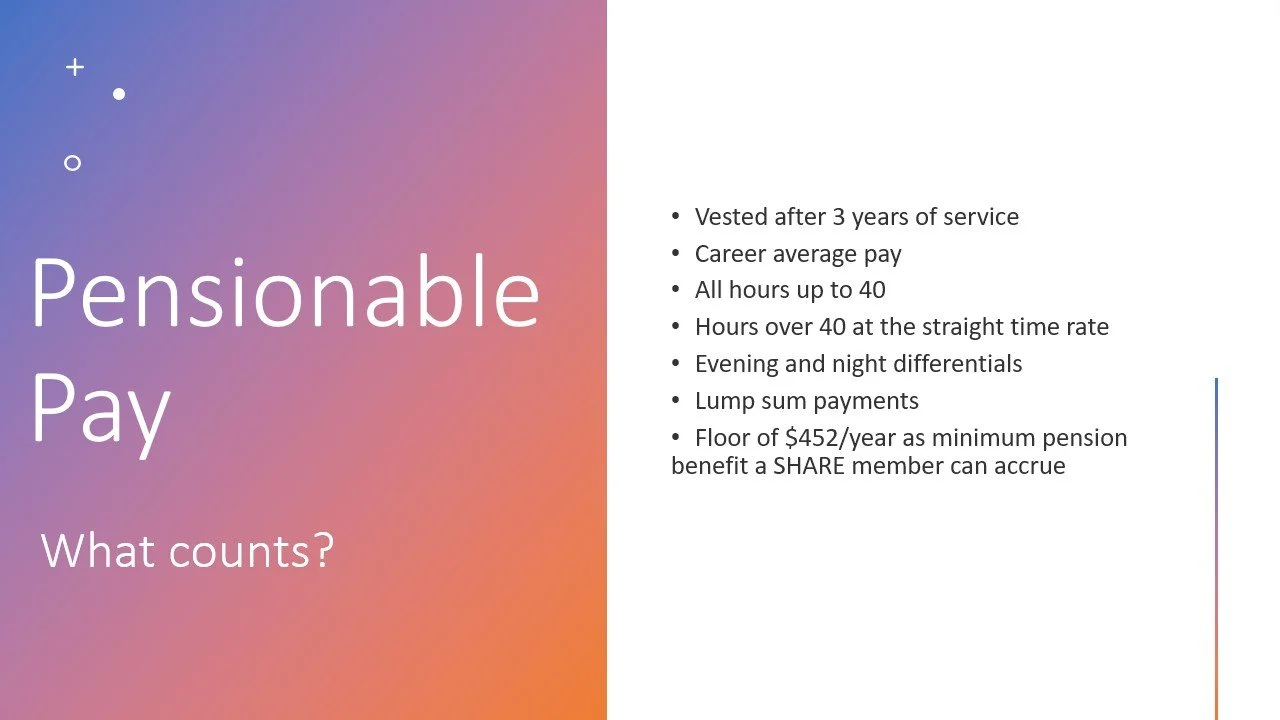

Your pension is not affected by the ups and downs of the stock market. The amount of your pension benefit is defined by a formula based on how much money you make, and your age when you start taking the pension. The longer you work at the hospital, the more money you make over your career at UMass Memorial, and the older you are when you retire, the bigger your monthly pension benefit amount will be. After three years of service with more than 1,000 hours worked each year, you’re vested in the pension, which means you own your pension. If you decide not to retire at age 65, you can request to begin collecting your pension while you work.

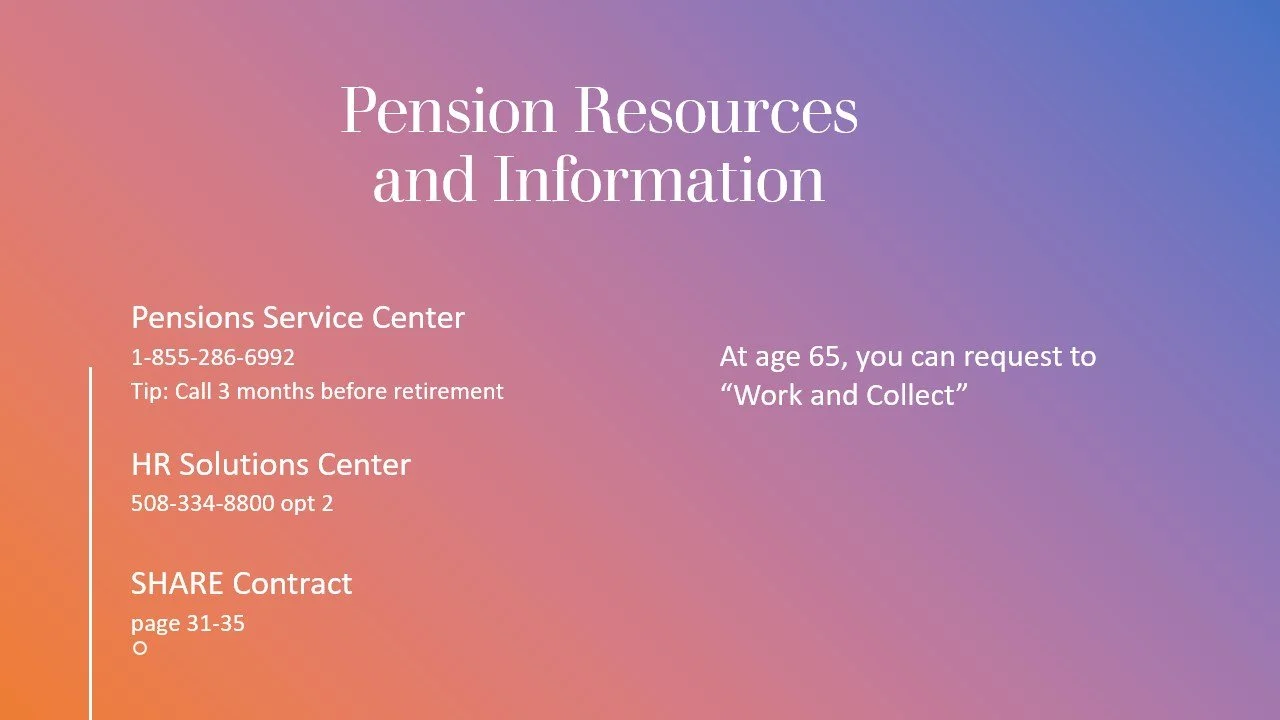

Pension Info | where can I learn more?

Pensions Service Center | 1-855-286-6992

HR Solutions Center | 508-334-8800 opt 2

SHARE Contract | page 31-35

Former SHARE union co-president and CT Tech Jay Hagan provided brilliant patient care at UMass Memorial for several decades. And now he’s now making the most of the SHARE retirement benefits, sometimes on a boat. He points out that if you don’t maximize your 401k, you’re leaving money on the table that the employer put there for you. Read more about how Jay lined up his own retirement plan here.

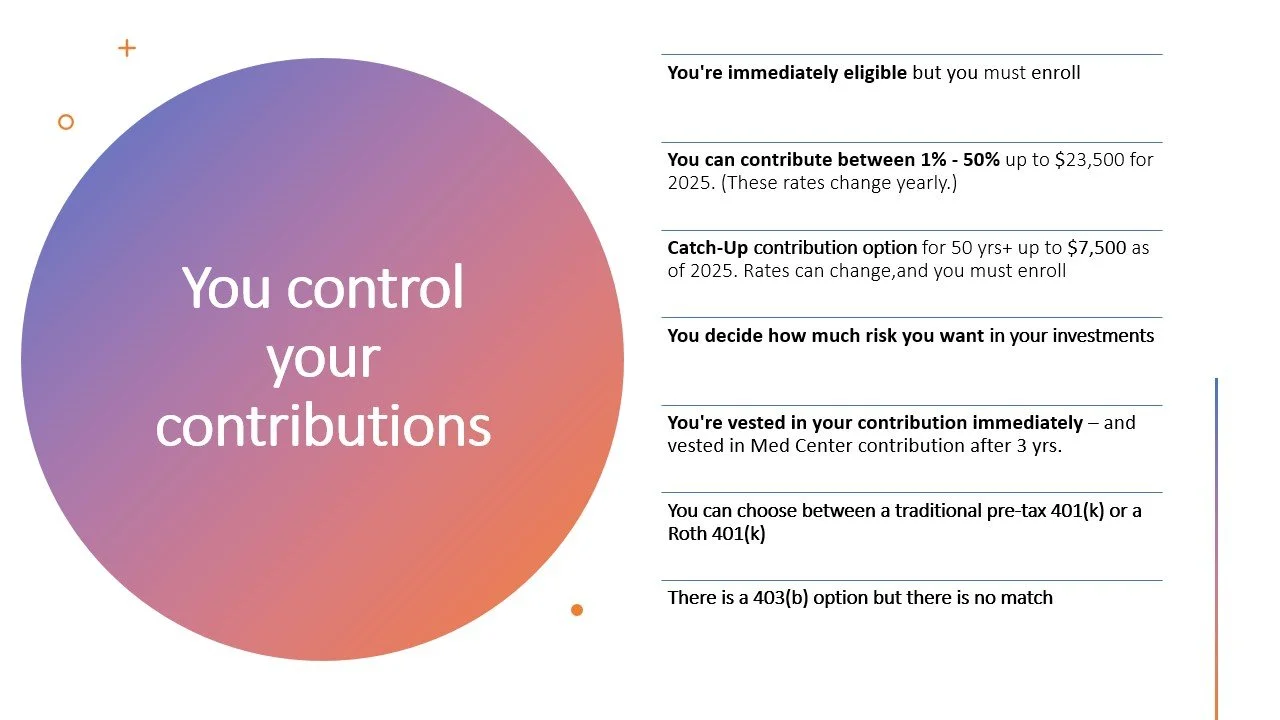

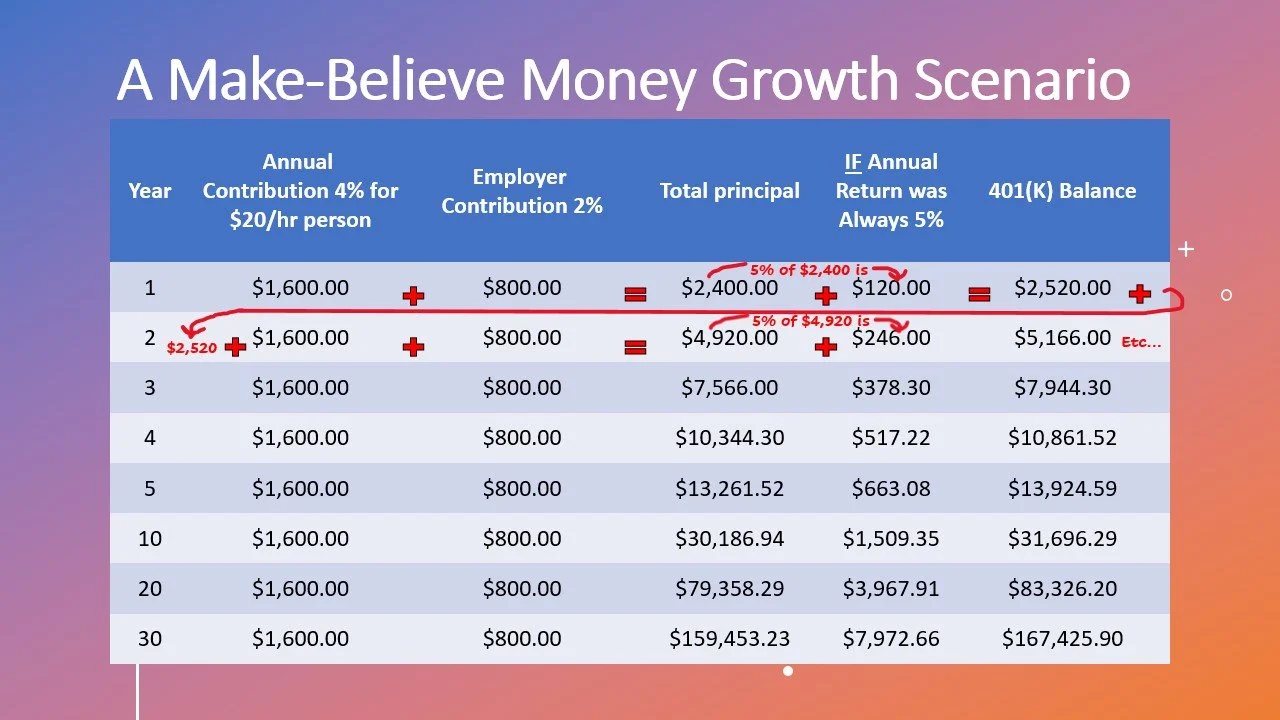

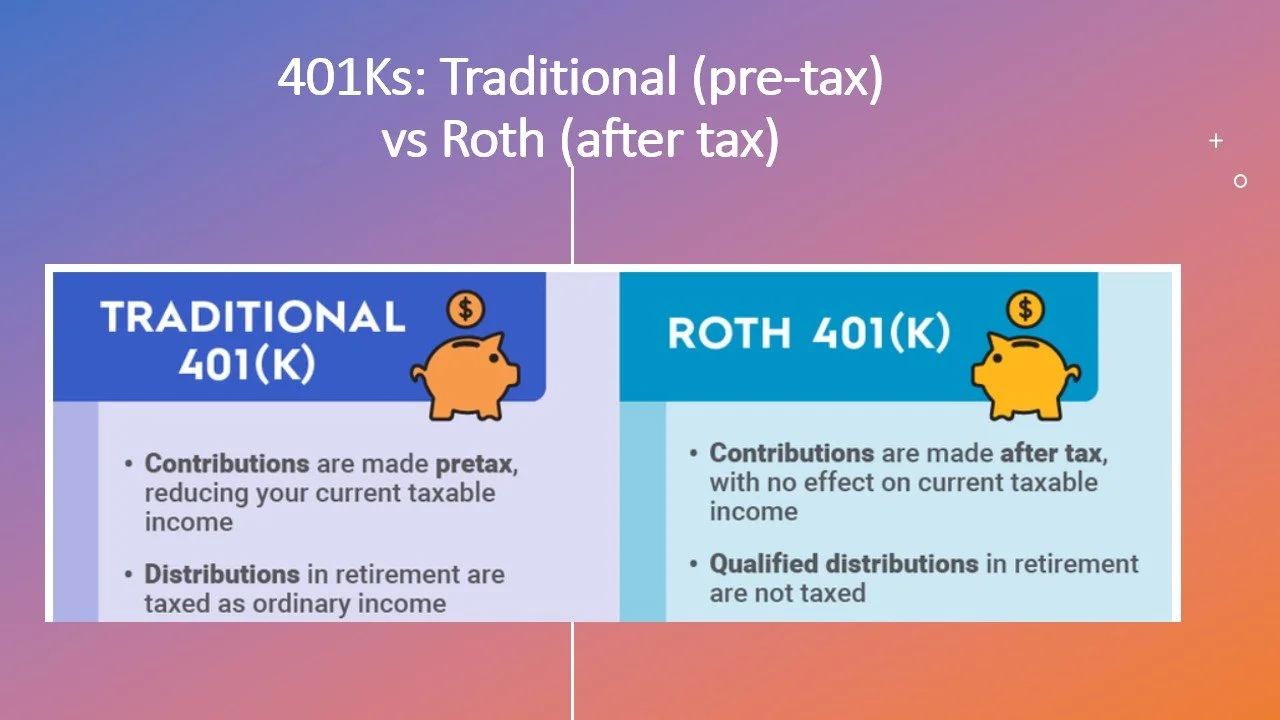

A 401(k) is a personal retirement investment savings account, which has tax advantages. You decide how much you want to contribute to your account from your paycheck each week. How much money you end up with in the account when you retire depends on your contributions plus the UMass Memorial match, plus any gains or losses in the investments that you chose. When you retire, you decide how much you take out of your 401(k) account each month. This is a benefit we’ve negotiated for in our contract.

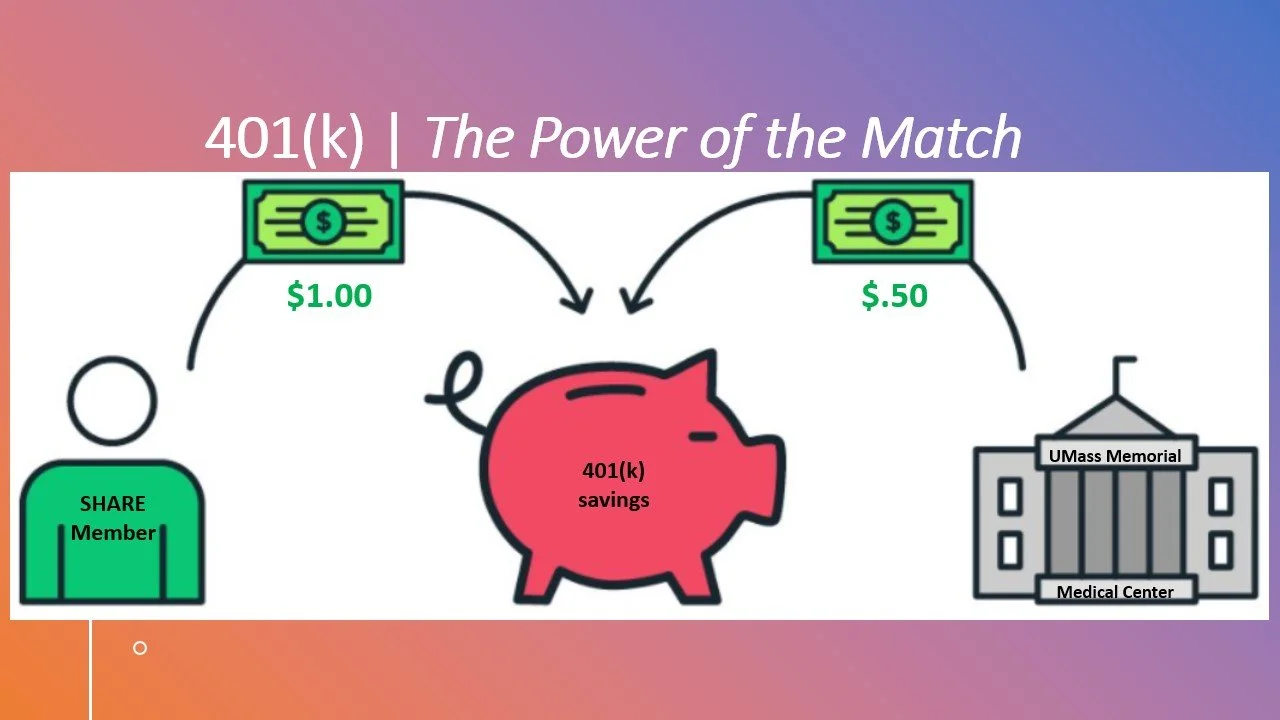

The Power of the Match

The hospital only contributes to your 401K if you do. For each dollar you contribute, UMass will match $0.50, up to the first 4% of your pay. You can contribute more, and get the tax benefits, but it won’t be matched by the hospital. You are immediately vested in your contributions, which means you own your contributions. You’re 100% vested in UMass Memorial’s contributions after 3 years of service or when you turn 55 years old.

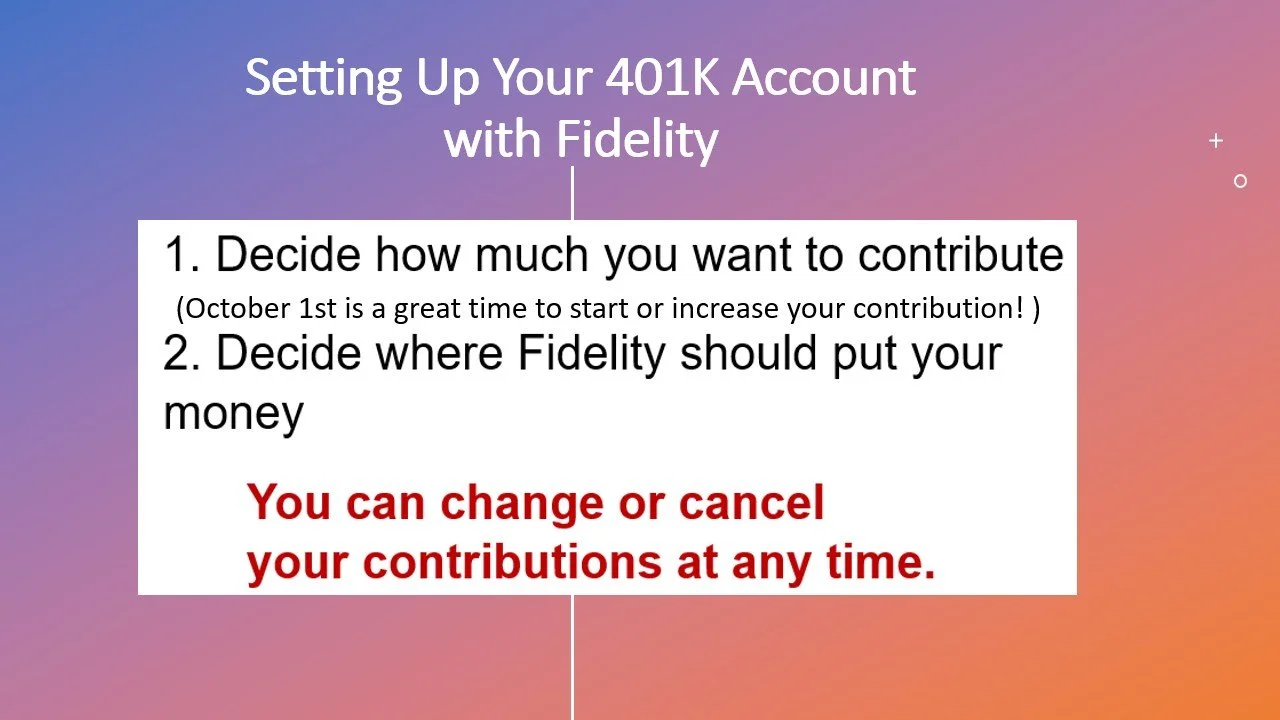

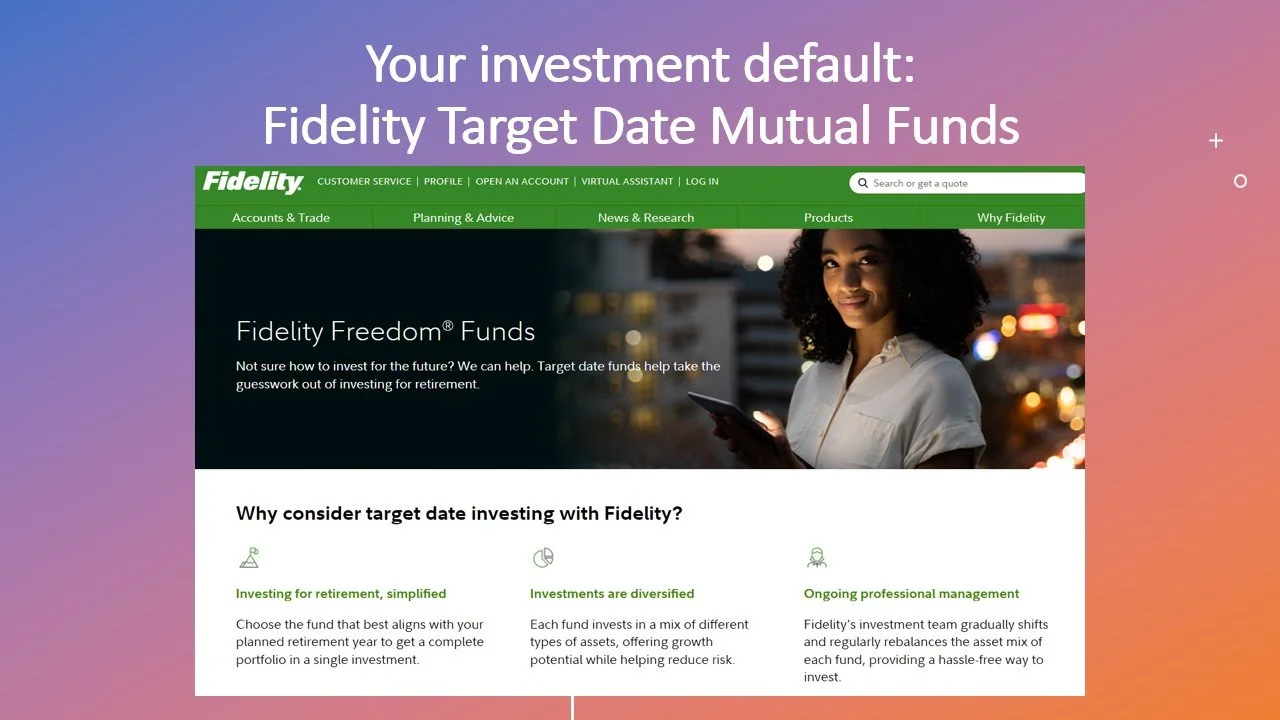

We encourage you to save for your retirement by going onto the Fidelity website and enrolling in the 401(k). Only you know what level of contribution makes sense for you and your family. More is better, but remember, a slow start is still a good start. For example, you can start by contributing the minimum of 1% of your pay now, and increase your contribution by 1% every October when we get a raise. Fidelity gives you choices about where you want your money to be invested, so you can choose how much risk you want to take.

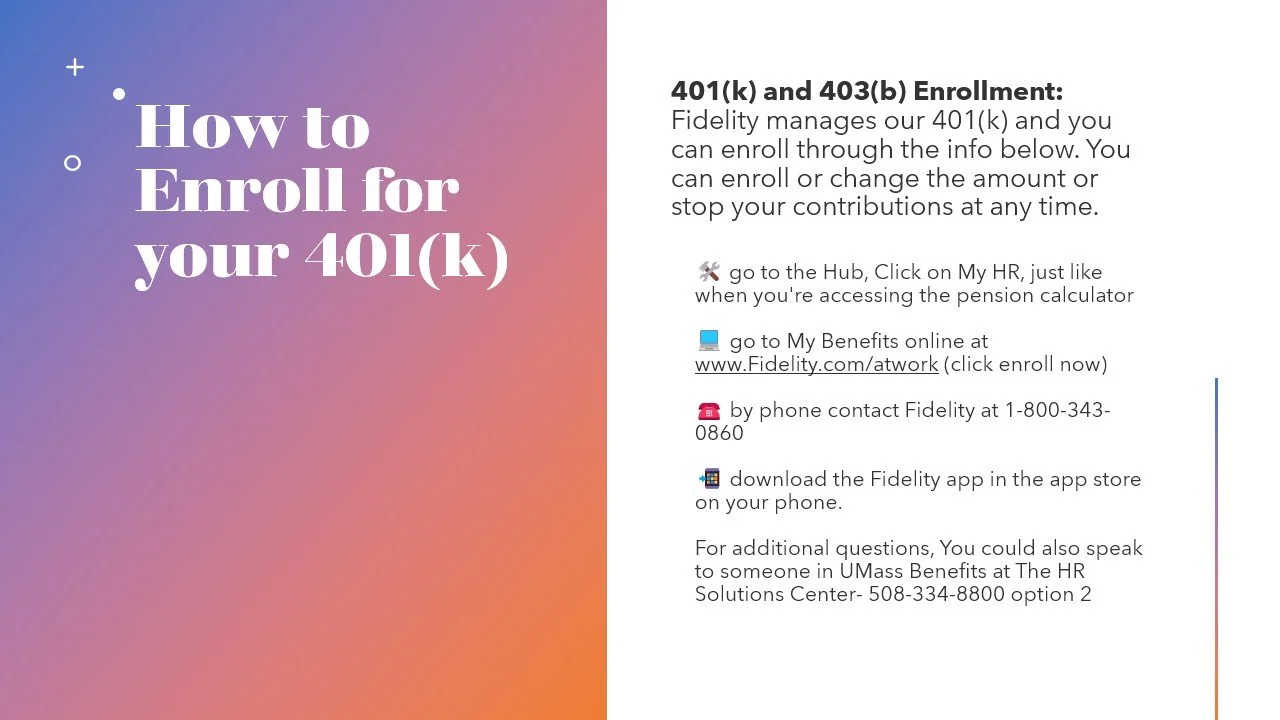

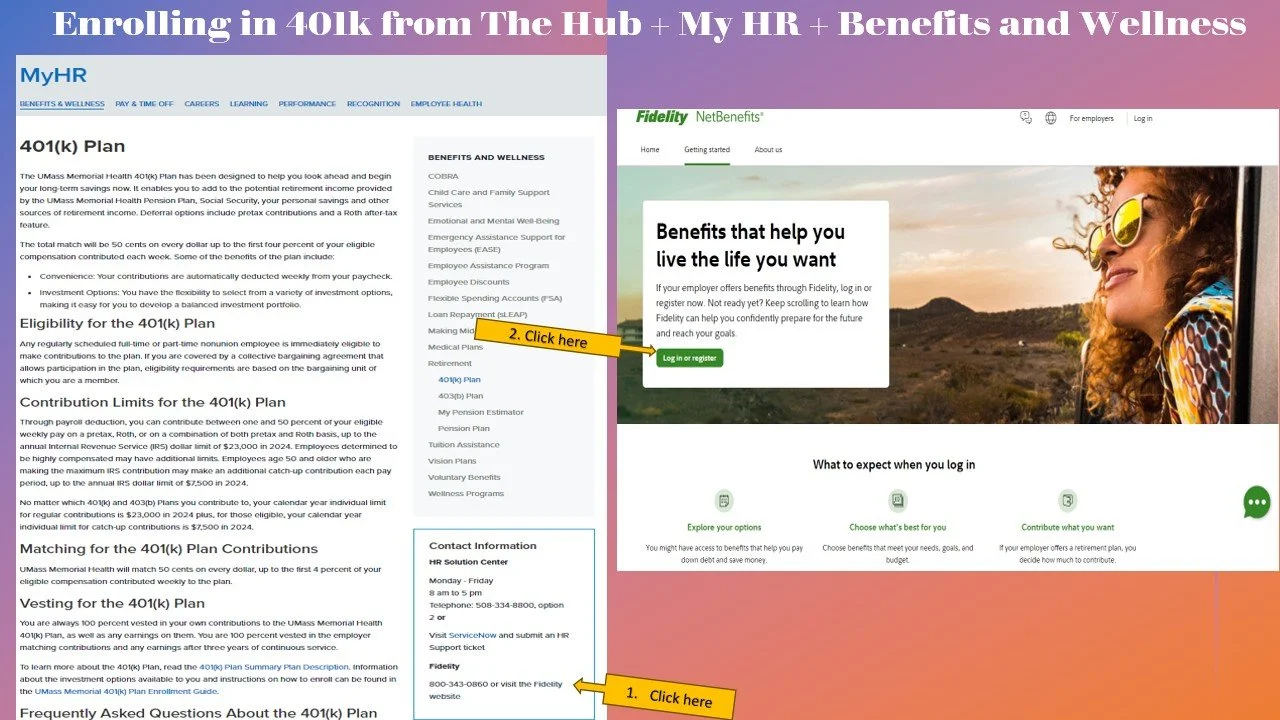

Enrollment: Fidelity manages our 401(k) and you can enroll through the info below. You can enroll or change the amount or stop your contributions at any time.

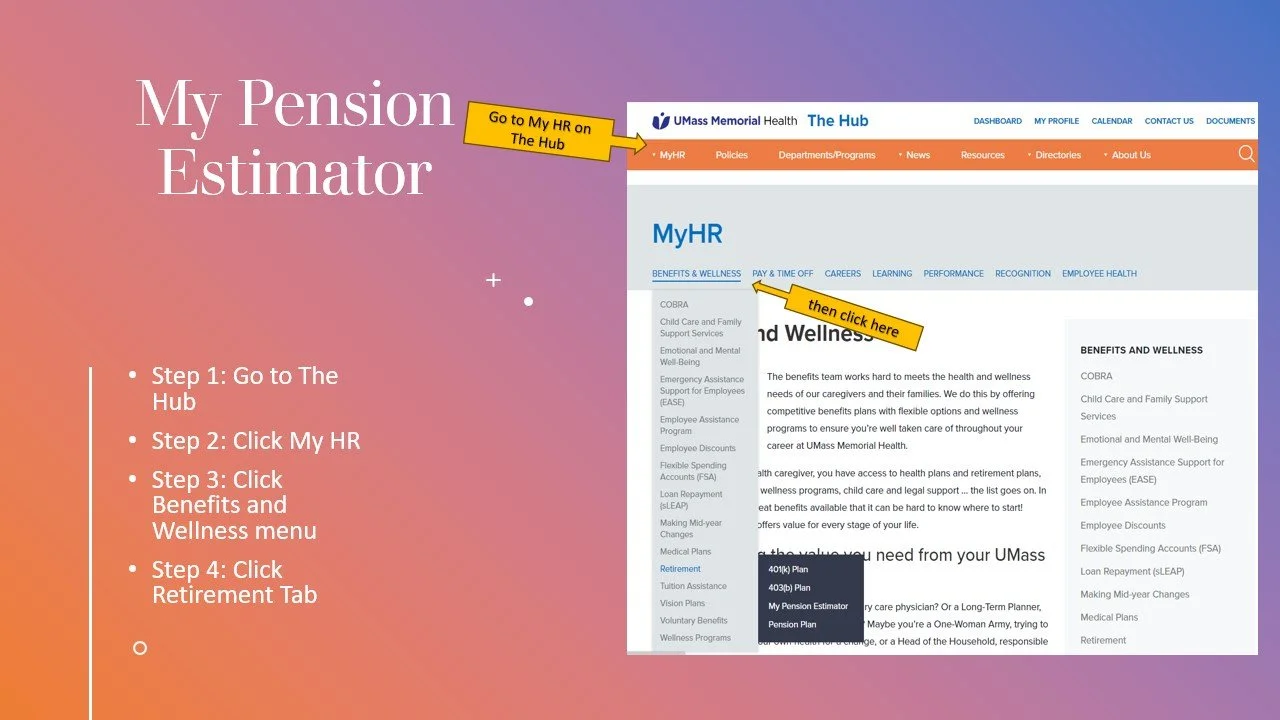

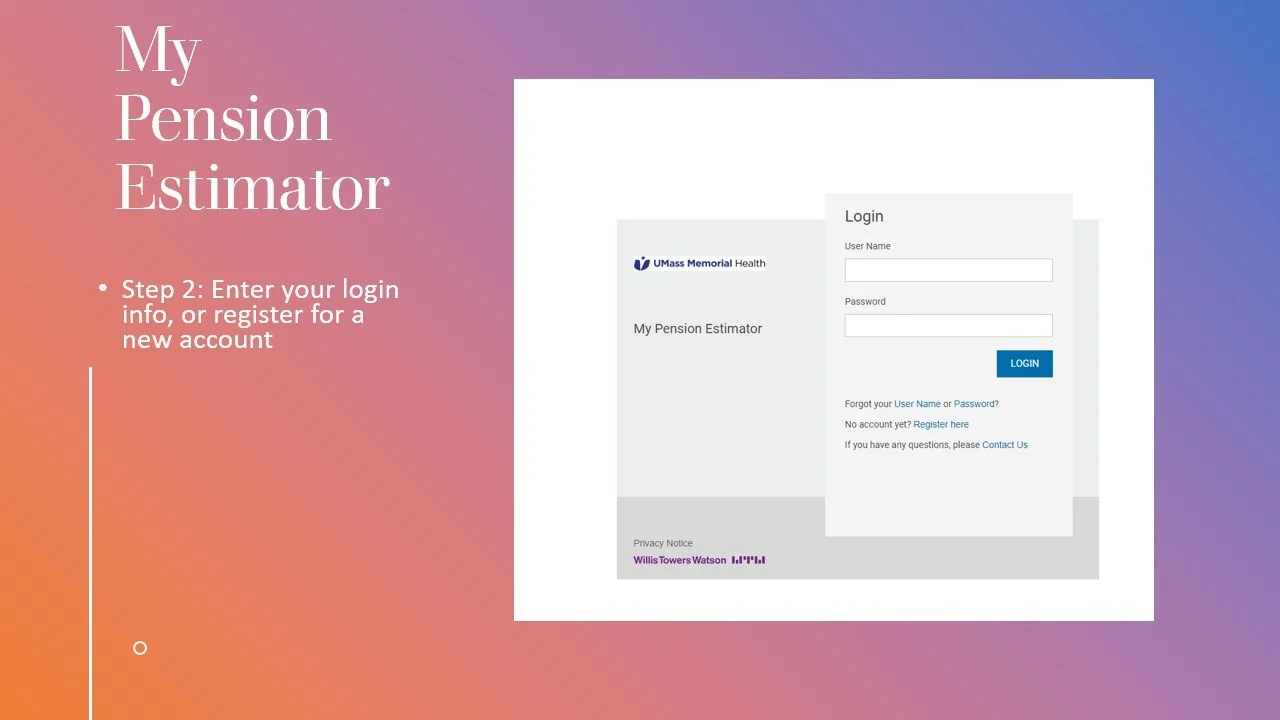

🛠️ go to the Hub, Click on My HR, just like when you're accessing the pension calculator

💻online at www.Fidelity.com/atwork

📞by phone at 1-800-343-0860

📲download the app in the app store on your phone.

SHARE Retirement Information Sessions

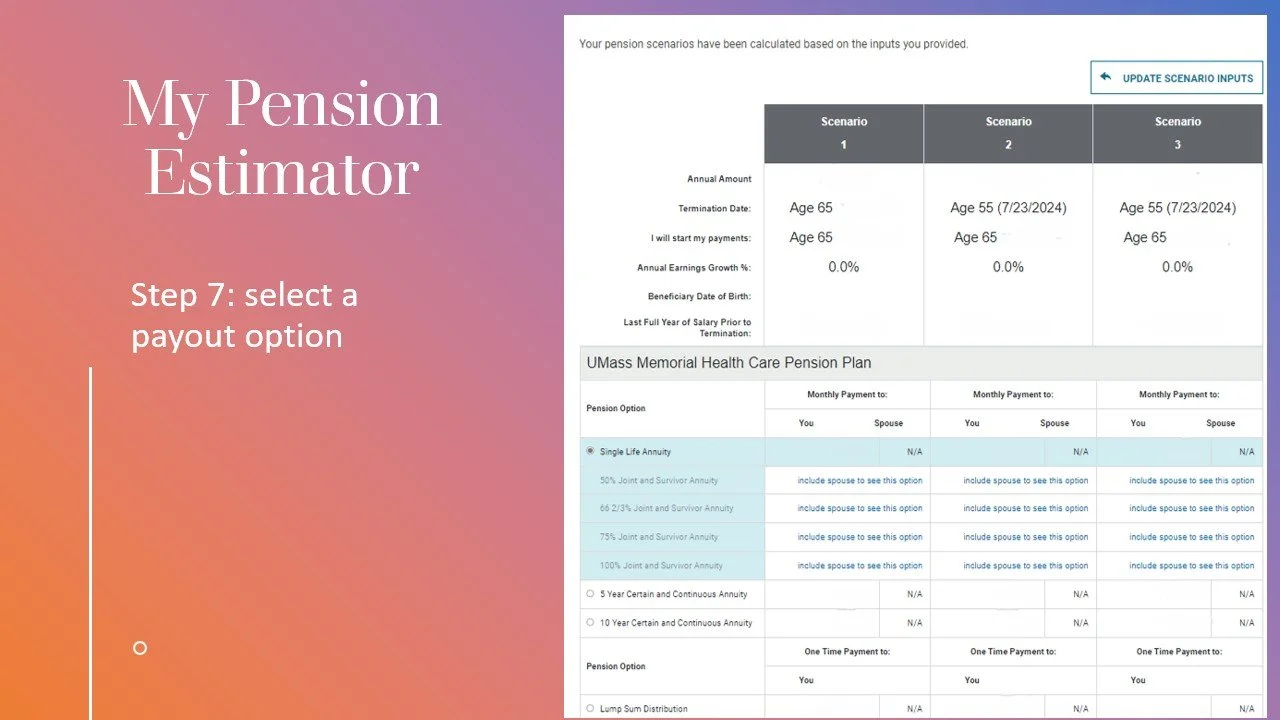

The images below are slides from SHARE Information Sessions about retirement. If you’d like to know when the next session is happening, have a question, or would like to request a session, please check the blog posts tagged #Retirement, or email SHARE

Important note: SHARE is not a financial expert or advisor, and cannot give financial advice for your situation. This factsheet is meant to explain just the basics of the UMass Memorial Medical Center pension and 401K. This factsheet does not apply to the retirement benefits of SHARE members at Marlborough Hospital.